The 8-Second Trick For Paypal Business Loan

Wiki Article

Top Guidelines Of Paypal Business Loan

Table of ContentsMore About Paypal Business LoanThe Best Strategy To Use For Paypal Business LoanSome Known Incorrect Statements About Paypal Business Loan Facts About Paypal Business Loan UncoveredGetting My Paypal Business Loan To Work

You'll have numerous alternatives when looking at start-up finances, consisting of SBA car loans, tools funding, credit lines, short-term financings, and company bank card. The payments will certainly be based on the amount of the lending, along with the rates of interest, term, and collateral. To qualify, it's generally essential to have a credit scores rating of 680 or greater.With a service purchase car loan, you'll obtain anywhere from $5,000 to $5,000,000. The terms can be revolving or for 10-25 years. The funds won't arrive particularly quickly, generally taking regarding a month to strike your account. One of the best facets of these fundings is that interest prices begin as low as 5 (PayPal Business Loan).

These beneficial prices suggest you'll save a substantial amount of cash over the lifetime of the loan. Obtaining a business purchase car loan can give a jumpstart to your service, as purchasing a franchise business or existing company is a fantastic method to step right into a practical service without the backbreaking work of building it from the ground up.

While the application differs depending upon whether you're acquiring a franchise business or existing organization, you can intend on loan providers assessing variables such as your credit report, organization tenure, as well as earnings. You'll require to offer records of business's efficiency and valuation, along with your very own service plan and economic forecasts.

6 Simple Techniques For Paypal Business Loan

There's no problem with your company bring financial obligation. The concern is whether your service can handle its financial obligation obligations. To obtain a you could try here grain on your organization financial debt coverage, a lending institution examine your cash circulation as well as financial obligation payments.

Lenders additionally care regarding the state of your company debt. What matters is whether the amount of financial obligation you're bring is proper contrasted to the dimension of your service and also the market you're working in.

Paypal Business Loan - Questions

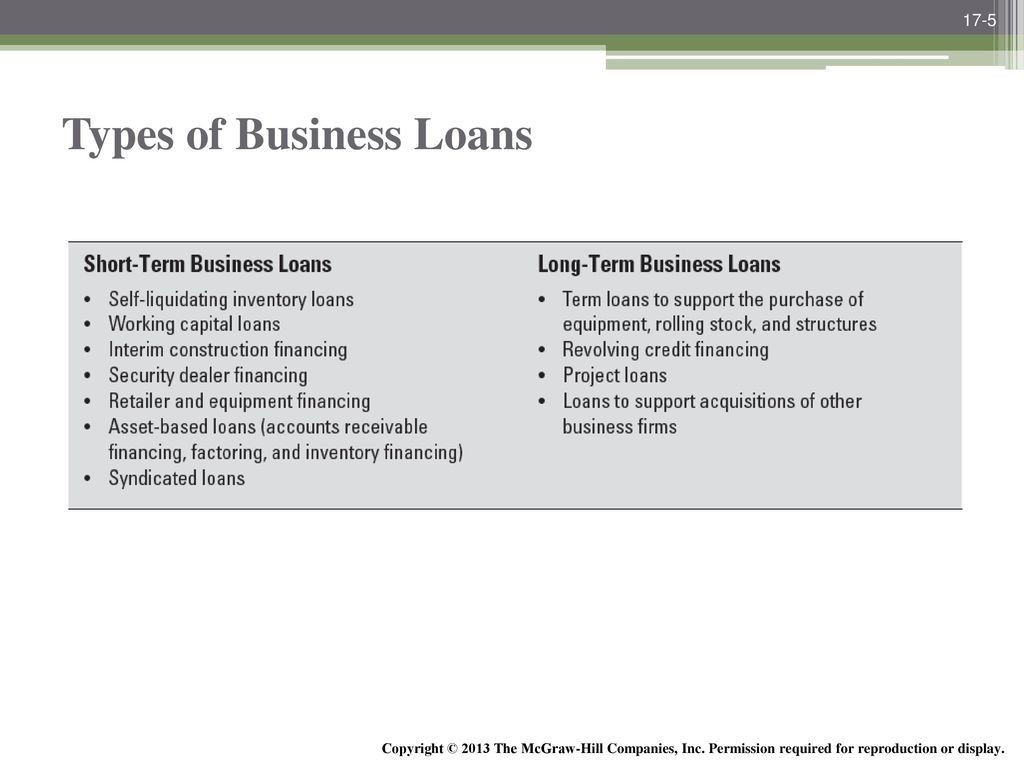

Lenders are extra motivated to collaborate with you if your business is trending in the right direction, so they'll intend to determine what your standard profits development will certainly more than time. If your own lands at or over the average for your industry, you're in terrific form. If you drop listed below the average, intend on there being some possible challenges in your pursuit of funding.There are various kinds of small-business financings everything from a business line of credit scores to invoice factoring to seller cash breakthroughs find more each with its own pros and also disadvantages. The ideal one for your company will certainly depend upon when you require the cash and also what you need it for. Below are the 10 most-popular kinds of business car loans.

Best for: Businesses wanting to broaden. Borrowers who have great credit score and a strong company and that do not intend to wait wish for funding. The Local business Administration assures these finances, which are supplied by financial institutions and other loan providers. Settlement durations on SBA finances depend on just how you intend to use the cash.

Prices will certainly depend on the worth of the devices and the stamina of your service. You can obtain competitive prices if you have solid credit report as well as business financial resources.

Paypal Business Loan for Beginners

Various other solutions might be supplied, such as consulting and training. Cons: Smaller funding amounts. You may have to meet stringent eligibility demands. Best for: Startups and organizations in deprived areas. Companies looking for just a percentage of financing.As we have actually gone over, there are several various kinds of company loansand the ideal one for your service inevitably comes down read the full info here to a number of factors. At the end of the day, each kind of little company financing is designed for a different organization demand. You'll need to consider your credit scores, your business's funds, the length of time you've been running, and also your reason for the financing prior to narrowing down your alternatives.

You'll likewise discover numerous options that you can capitalize on if a small business loan is not your ideal funding option. There are certain things that every tiny business proprietor must know before heading down the application process. Below are the five major realities to understand: They're all various.

How Paypal Business Loan can Save You Time, Stress, and Money.

There are a great deal of scams. Know your debt service protection proportion. Be prepared to back your service. Let's get going: Bank loan are as diverse as the tiny business owners that apply for them. Not every lender functions in the same way, and also also within the very same loaning company, you'll locate various sorts of fundings.Report this wiki page